量化交易核心策略之最优配对交易

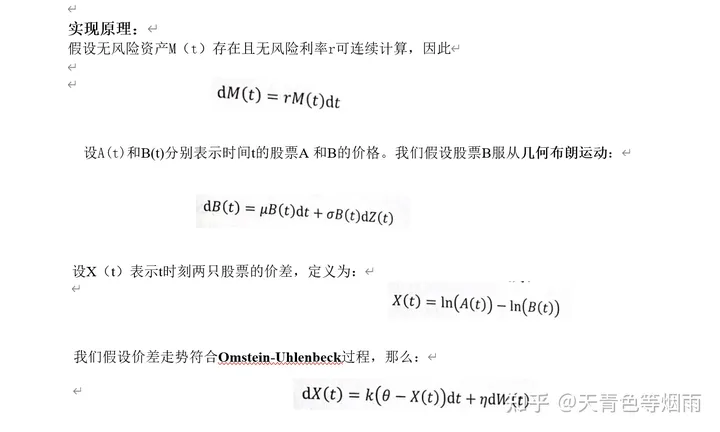

本内容基于论文《最优配对交易》,策略是基于相互间的走势相近的股票对,当两者间的差价偏离均值时,我们认为他们的关系会回归长期的均值,根据策略进行交易,以便从这一回归行为中获利。

标准的例子是同一行业中的一对高度相关的股票。配对交易策略仅仅依赖于证券对之间的相对关系,而不是市场的整体走势,它是一种市场的中性的策略。

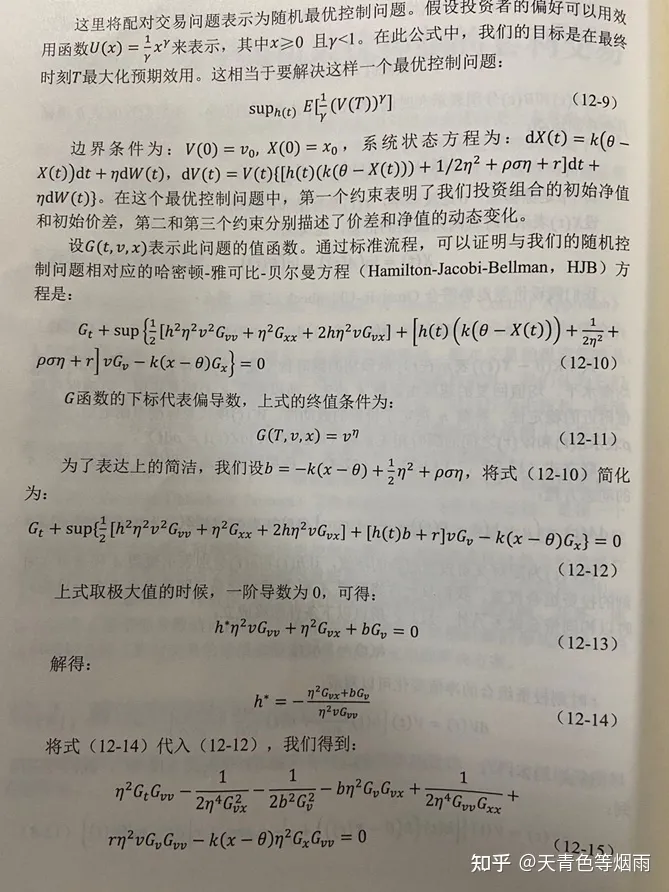

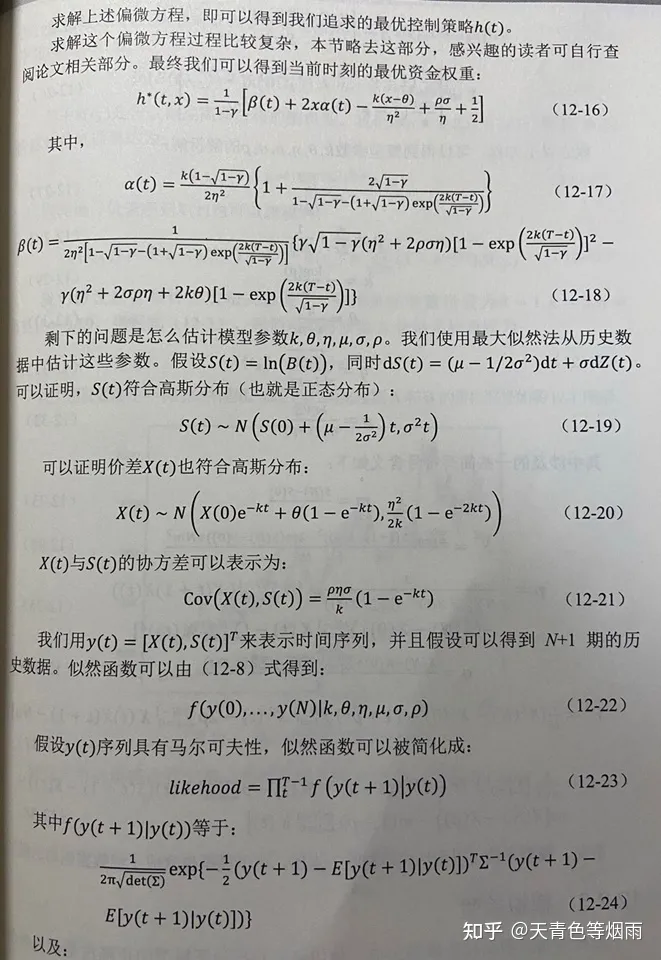

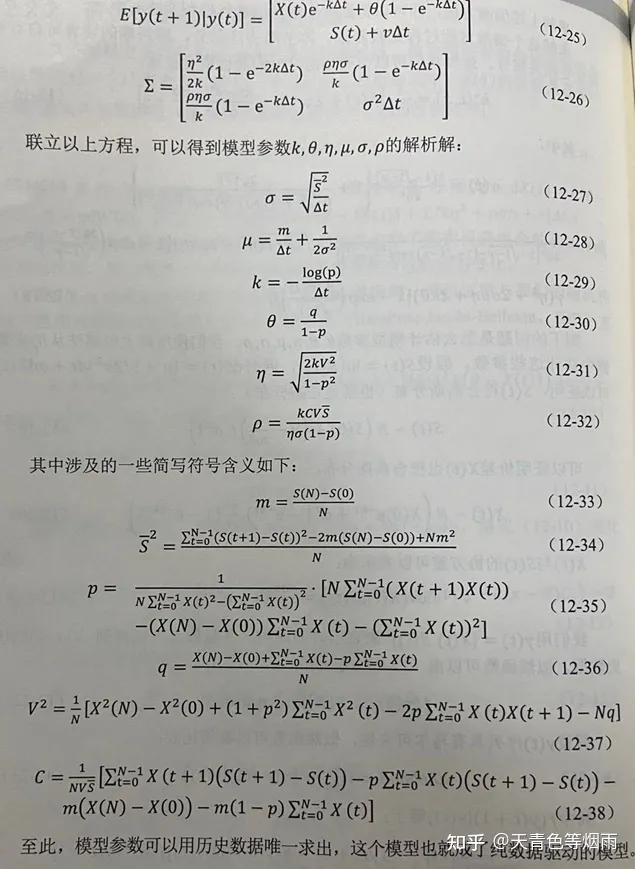

论文中作者开发了一个假设股票间对数价差符合OU过程的模型。OU过程是一个平稳的高斯-马尔可夫过程,其数学期望为0且指数函数为核函数。将动态投资组合优化问题转化为随机控制问题。假设投资者可以基于价差进行交易或者将资金放入无风险资产中,他们能够为将资产净值作为控制目标的控制问题找到一个解析解。

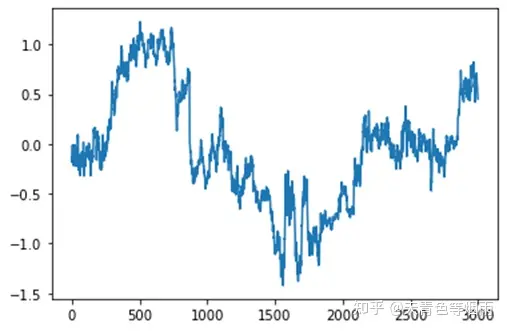

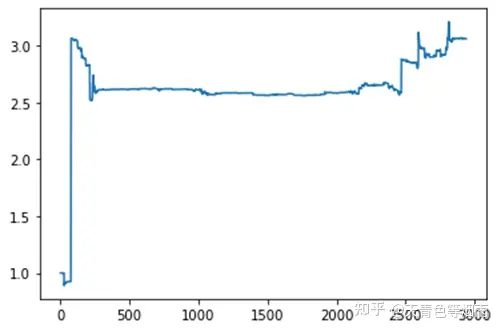

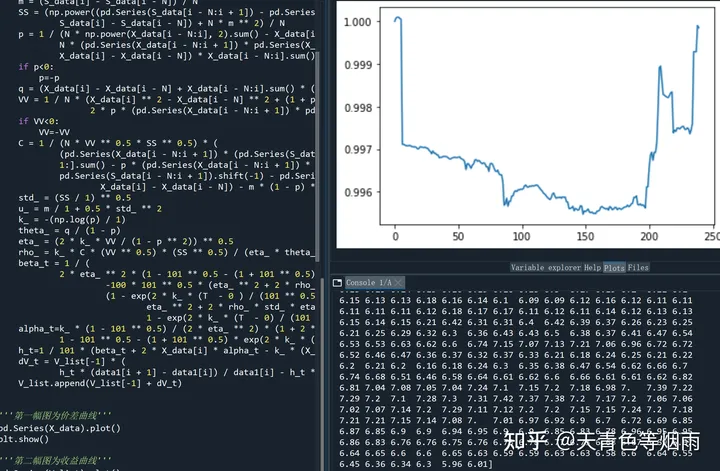

通过代码测试了上海贝岭和士兰微最近300个交易日的数据,通过策略可以获得3倍收益。(仅为理论参考)

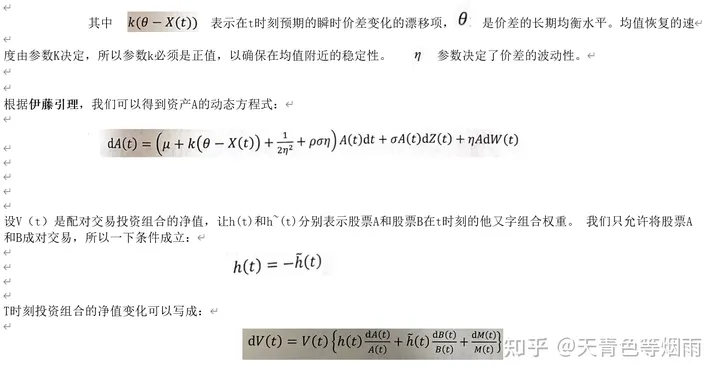

但是,在回测中国银行和中国建设银行的历史数据上,效果并不理想。

可以优化的地方很多,希望得到更多的意见。

这是中国银行和建设银行策略组合的收益曲线,可以说是悬崖是回撤。

最后附上代码:

import pandas as pd

import numpy as np

from math import exp

import matplotlib.pyplot as plt

df2 = pd.read_csv(

filepath_or_buffer=r’C:\Users\kongx\Desktop\KONG_QUANT\Data\stock\sh600171.csv’,

encoding=’gbk’,

sep=’,’,

# 该参数代表跳过数据文件的的第1行不读入

skiprows=1,

# parse_dates=[‘交易日期’],

# index_col=[‘交易日期’],

)

df1 = pd.read_csv(

filepath_or_buffer=r’C:\Users\kongx\Desktop\KONG_QUANT\Data\stock\sh600460.csv’,

encoding=’gbk’,

sep=’,’,

# 该参数代表跳过数据文件的的第1行不读入

skiprows=1,

# parse_dates=[‘交易日期’],

# index_col=[‘交易日期’],

)

data1 = df1.tail(300)

data2 = df2.tail(300)

data1 = data1.iloc[:, 5].values

data2 = data2.iloc[:, 5].values

print(data1)

print(data2)

S_data = np.log(data2)

X_data = np.log(data1) – np.log(data2)

”’

真实回测前,需预设一些参数:

”’

N = 60

T = 1

r = -100

V_list = [1]

for i in range(N, len(data1) – 1): # 滚动窗口计算参数估计值

m = (S_data[i] – S_data[i – N]) / N

SS = (np.power((pd.Series(S_data[i – N:i + 1]) – pd.Series(S_data[i – N:i + 1]).shift(1)), 2)[1:].sum() – 2 * m * (

S_data[i] – S_data[i – N]) + N * m ** 2) / N

p = 1 / (N * np.power(X_data[i – N:i], 2).sum() – X_data[i – N:i].sum() ** 2) * (

N * (pd.Series(X_data[i – N:i + 1]) * pd.Series(X_data[i – N:i + 1]))[1:].sum() – (

X_data[i] – X_data[i – N]) * X_data[i – N:i].sum() – np.power(X_data[i – N:i].sum(), 2))

if p<0:

p=-p

q = (X_data[i] – X_data[i – N] + X_data[i – N:i].sum() * (1 – p)) / N

VV = 1 / N * (X_data[i] ** 2 – X_data[i – N] ** 2 + (1 + p ** 2) * np.power(X_data[i – N:i], 2).sum() –

2 * p * (pd.Series(X_data[i – N:i + 1]) * pd.Series(X_data[i – N:i + 1]))[1:].sum() – N * q)

if VV<0:

VV=-VV

C = 1 / (N * VV ** 0.5 * SS ** 0.5) * (

(pd.Series(X_data[i – N:i + 1]) * (pd.Series(S_data[i – N:i + 1]) – pd.Series(S_data[i – N:i + 1]).shift(1)))[

1:].sum() – p * (pd.Series(X_data[i – N:i + 1]) * (

pd.Series(S_data[i – N:i + 1]).shift(-1) – pd.Series(S_data[i – N:i + 1])))[:-1].sum() – m * (

X_data[i] – X_data[i – N]) – m * (1 – p) * pd.Series(X_data[i – N:i]).sum())

std_ = (SS / 1) ** 0.5

u_ = m / 1 + 0.5 * std_ ** 2

k_ = -(np.log(p) / 1)

theta_ = q / (1 – p)

eta_ = (2 * k_ * VV / (1 – p ** 2)) ** 0.5

rho_ = k_ * C * (VV ** 0.5) * (SS ** 0.5) / (eta_ * theta_ * (1 – p))

beta_t = 1 / (

2 * eta_ ** 2 * (1 – 101 ** 0.5 – (1 + 101 ** 0.5) * exp(2 * k_ * (T – 0) / (101 ** 0.5)))) * (

-100 * 101 ** 0.5 * (eta_ ** 2 + 2 * rho_ * std_* eta_) * (

(1 – exp(2 * k_ * (T – 0 ) / (101 ** 0.5))) ** 2) + 100 * (

eta_ ** 2 + 2 * rho_ * std_ * eta_ + 2 * k_*theta_) * (

1 – exp(2 * k_ * (T – 0) / (101 ** 0.5))))

alpha_t=k_ * (1 – 101 ** 0.5) / (2 * eta_ ** 2) * (1 + 2 * 101 ** 0.5 / (

1 – 101 ** 0.5 – (1 + 101 ** 0.5) * exp(2 * k_ * (T – 0 ) / (101 ** 0.5))))

h_t=1 / 101 * (beta_t + 2 * X_data[i] * alpha_t – k_ * (X_data[i] – theta_) / (eta_ ** 2) + rho_ * std_ / eta_ + 0.5)

dV_t = V_list[-1] * (

h_t * (data1[i + 1] – data1[i]) / data1[i] – h_t * (data2[i + 1] – data2[i]) / data2[i])

V_list.append(V_list[-1] + dV_t)

”’第一幅图为价差曲线”’

pd.Series(X_data).plot()

plt.show()

”’第二幅图为收益曲线”’

pd.Series(V_list).plot()

plt.show()

This message is used to verify that this feed (feedId:71868346174585856) belongs to me (userId:71867633126761472). Join me in enjoying the next generation information browser https://follow.is.

I used to be able to find good advice from your blog

posts. https://U7Bm8.mssg.me/

Hello my loved one! I wish to say that this post is amazing,

nice writtten andd include almost all important infos.

I’d likme to peer more posys like this . https://yv6Bg.mssg.me/

Link exchange is nothing else but it is only placing the other person’s webpage link on your page at suitable place and other

person wiill also do similar for you. https://bookofdead34.wordpress.com

Very good blog! Do you have any tips for aspiring writers? I’m hoping to

start my own site soon but I’m a little lost on everything.

Would you advise starting with a free platform lke WordPress or go for a

paid option? There are soo many choices out there that I’m totally confused ..

Any recommendations? Bless you! https://www.makemyjobs.in/companies/tonebet-casino/